Europe is facing a natural gas shortage just as Russia is completing a controversial pipeline to Germany, increasing Russia’s leverage over the continent’s energy flows. Europe’s gas stores are at their lowest (the part of which is owned by Gazprom) levels for years after demand rebounded from a pandemic-induced low that had led producers to slash output. As a result, prices are hitting record levels and utilities are firing up coalfired power stations to keep their own costs down.

Despite this, Russia, Europe’s biggest gas supplier, has declined to book big additional flows through pipelines in Ukraine, which are running below full capacity. A large share of Russian gas exports to Europe transits through neighbor Ukraine, but that is expected to change after Russia completes construction of the Nord Stream 2 pipeline, which the company running the construction expects to happen this month. This will allow Gazprom to export directly to Germany and bypass Ukraine and Poland, whose governments are critical of Russia.

From commercial as well as from political viewpoint the project is only beneficial for the Russian Federation. The pipeline can be used as the weapon not only to punish Ukraine and other Eastern European countries cutting them from the supply of natural gas but also it gives Russia greater leeway to influence gas prices in Europe. Russia and Germany say Nord Stream 2 is a commercial project, providing a shorter and cheaper route for gas supplies.

Russia accounted for half of gas imports by the EU in the first quarter of this year, well ahead of Norway on 24%, according to the European Commission. Nord Stream 2 AG, the unit of Russian state-controlled gas giant Gazprom PJSC that is building the pipeline, says Europe will need increasing amounts of Russian gas in addition to gas from other sources to meet demand as domestic fossil-fuel production shrinks in the coming years. Mr. Putin said Friday that less than 10 miles of pipe needed to be laid to complete Nord Stream 2, which will double the capacity of an existing link to Germany to 110 billion cubic meters a year. Gazprom says it sold 175 billion cubic meters to Europe, including Turkey, in 2020.

Gazprom says it could pump 5.6 billion cubic meters of gas via Nord Stream 2 this year, which could still be too little to make up the current shortfall if the winter is cold, analysts said. Europe has 73 billion cubic meters of gas in storage, about 18% below the five-year average for the time of year, according to S&P Global Platts. This is the lowest figure for this time of year in the last eight years. Gas stocks in the four largest UGS facilities of Gazprom in Europe – the Austrian Haidach, the German Rehden and Jemgum and the Dutch storage Bergermeer – amount to about 1.8 billion cubic meters of gas out of the total design volume of just over 10 billion cubic meters. As of August 16, the occupancy of UGS facilities in Europe was estimated at 61.87%, while at the beginning of August it was 57.19%. In total, they contain 67.23 billion cubic meters of gas against 62.15 billion cubic meters at the beginning of the month, which is the lowest figure for this time of the year over the past nine years.

James Huckstepp, lead European gas analyst at the commodities-data firm, said much of the gas that flows through Nord Stream 2 this year will be diverted from other pipelines rather than representing additional fuel. He said Gazprom doesn’t have the capacity to produce large extra volumes after a lack of investment in gas fields during a stretch of low prices in recent years. In Poland, experts expect westbound gas flows via Poland on the Yamal-Europe pipeline to fall once Nord Stream 2 is working and the European gas market has cooled.

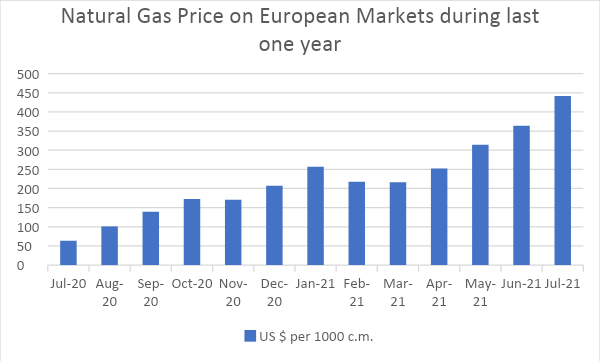

Meanwhile, last month, Gazprom decided to raise the average gas export price for European countries. The company’s managers expect it to reach $240 this year, which is way more than what Gazprom and market analysts had forecasted. During this summer, Gazprom PJSC has been withdrawing natural gas from some of Europe’s storage facilities, denting critical efforts to rebuild supplies ahead of winter. Inventories are being withdrawn from Gazprom’s Rehden storage site in Germany since last week, according to data from Gas Infrastructure Europe. The amount of gas taken from Katharina site, another gas storage facility in Germany, co-owned by Gazprom, jumped last week to the most in more than a year.

On top of it, simultaneously to the depletion of European gas storage facilities, Gazprom has slowed the delivery of piped natural gas to Europe in recent weeks, according to analysis from ICIS, a commodity intelligence service, raising questions about the potential causes behind the drop and its implications for global gas markets. Natural gas flows at the westernmost point of the Yamal Pipeline — a strategically important 2,000-kilometer pipeline that runs across four countries: Russia, Belarus, Poland and Germany — dropped to 20 million cubic meters per day in mid-August, according to ICIS. This was down from 49 mcm per day at the end of July, and a sharp fall from its typical rate of 81 mcm per day.

European gas market prices have skyrocketed more than 116% since the start of the year, with the ICIS TTF benchmark closing at an all-time high of 47.86 euros ($56.17) per megawatt-hour on Aug. 16. It is reflective of a tight market, with Europe facing incredibly low natural gas storage levels and rebounding Asian and South American LNG demand.